Pradhan Mantri Mudra Loan Yojana was launched by the Prime Minister of our country, Shri Narendra Modi in the year 2015. PMMY scheme, loans are being provided to the people of the country to start their own small business.

PM Mudra Loan Scheme main initiative will be the loan facilities are being given to small and medium businessmen and youth to promote self-employment. Under this scheme, the central government has prepared a budget of Rs 3 lakh crore, under which loans will be given without any processing charge. Pradhan Mantri Mudra Loan Yojana 2022 loans are given in three phases. If your business is also not able to progress due to lack of money, then you can also take Mudra loan from 50,000 to 10,00,000 rupees. If you are selected for Mudra Yojana, then you will be given a Mudra card to take advantage of this scheme.

Highlights of the Pradhan Mantri Mudra Loan Yojana (PMMY)

| Scheme Name | Pradhan Mantri Mudra Loan Yojana |

|---|---|

| Started by | Prime Minister Narendra Modi |

| Scheme Start Date Year | 2015 |

| people of the beneficiary | Indian |

| purpose of Mundra Yojana | providing loan |

| Beneficiary | Small and Medium Entrepreneur Startups |

| Loan amount | up to Rs 10 lakh |

| Mode of Application | Offline |

| Start Application Form | Available Now |

| Official website | https://www.mudra.org.in/ |

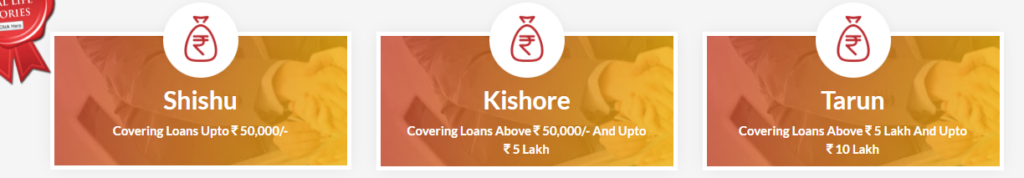

Category of Pradhan Mantri Mudra Yojana 2022 :

Shishu Loan – Under the Shisu Mudra Loan, a loan of up to ₹ 50000.

Kishore Loan – Under the Kishore Mudra scheme, loan from 50000 to 5 lakh will be allotted to the beneficiaries.

Tarun Loan – Under the Tarun Mudra scheme, loans ranging from 500000 to ₹ 1000000 will be allotted to the beneficiaries.

मुद्रा कार्ड | Mudra Card

Every Mudra Loan beneficiaries will get Mudra Card. Mudra Yojana Card beneficiary can withdraw the money from ATM as per like other debit card you use. The applicant will be provided with a password, from which the applicant will have to keep the Confidential and the applicant can use this card to fulfill his business related needs.

PM Mudra Loan Yojana 2022 Required Documents | मुद्रा लोन लेने के लिए आवश्यक दस्तावेज

- mobile number

- applicant’s Aadhar card

- driving license

- pan card

- Voter ID Card

- sales tax return

- income tax return

- last year’s balance sheet

- mobile number

- bank account

Who can take advantage of Pradhan Mantri Mudra Yojana?

- sole proprietor

- micro industry

- repair shop

- truck owners

- food business

- Vendor (Fruits & Vegetables)

- micro manufacturing firm

- service sector companies

How to apply online Pradhan Mantri Mudra Yojana 2022

- Firstly you need to go to the official website of Mudra Yojana. The home page will open in front of you.

- On the homepage of the website, you will see the types of Mudra Yojana at bottom which are as follows:-

1. Shishu 2. Kishor 3. Tarun

- Here you have to select any one Option type according to you, after which a new page will open in front of you.

- Now You have to download the application form from this page. After form downloaded, you should take a print-out of it.

- fill all the information asked in the PM Mudra application form.

- After this you need to attach all the important documents.

- Next step to submit this mudra yojana application form to your nearest bank.

- The mudra loan will be provided within 1 month after the verification of your PM mudra Yojana application .

Official Website for PM Mudra Scheme :- Click Here

if any person who wants to start his business can take loan under Pradhan Mantri Mudra Loan Yojana 2022(PMMY) and if he wants to carry forward his existing business and needs the money; So he can very easily apply for a loan up to ₹ 10,00000 under this mudra scheme.

Also Check :-